Dominance of Renewable Energy Projects

By Mr. Shashikant Hegde, Director, Projects Today

Govt. Commitments down by 30.5%

The 99th Survey of Projects Investment in India reveals a significant transformation in the sectoral composition of new investment plans during the first quarter of FY26 (April–June 2025). The Solar and Wind energy sectors, which have consistently attracted rising private interest since early 2024, emerged as the dominant recipients of fresh investment commitments in the latest quarter. The two sectors together attracted more fresh investment commitments than the two other major sectors, Manufacturing and Infrastructure.

The sharp decline in infrastructure investment can be attributed largely to reduced capital expenditure by government agencies. Meanwhile, momentum in the Manufacturing sector slowed as companies grappled with tepid demand recovery, persisting uncertainties surrounding global tariff regimes, and continued geopolitical tensions.

By Ownership

The story of this Survey as explained above, is the fall in new capex plans by the Government sector (both Central and State) in the Infrastructure sector and the flow of increased investment plans of Private sector towards building new Solar and Wind capacities.

In the Government sector, between the two latest quarters, fresh investment decreased by 30.45%, i.e. from Rs 6,27,494.97 crore in Q4/FY25 to Rs 4,36,427.48 crore in Q1/FY26. As a result, its share in the total investment pie declined 40.77% in Q4/FY25 to 25.07% in Q1/FY26. Within this sector, the fall in fresh investment was sharper in the Central government sector at -40.91%. The Rs 1,75,585.39 crore aggregate investment indicated a fall in investment commitments by Rs 1,21,552 crore as compared with the previous quarter figures.

Fresh investment in the Private sector increased by 43.11% in Q1/FY26. Almost half of the fresh investment seen in this quarter was directed into setting up new Solar/Wind power projects. These projects, together, aim to add new capacities of 1,30,000 MW over the next 3 to 5 years.

Even if 75% of these projects fructify, the country will see an addition of 97,500 MW capacity in the next couple of years. This will help the nation in achieving its target of setting up 500 GW of non-conventional capacity by 2030.

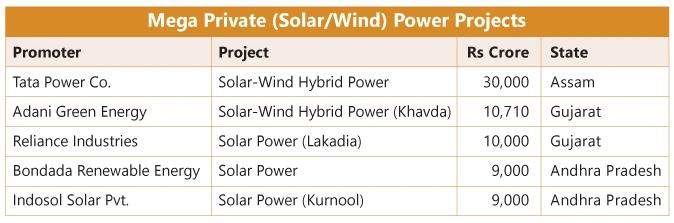

Some of the largest private projects are: (TABLE – PT-Mag Tables Excel)

By Sectors

Electricity: As explained above the main highlight of the current Survey is the exponential surge in fresh investment seen in the Solar/Wind power projects. While the Electricity sector saw an increase of fresh investment of 83.78% on a Q-o-Q basis (566 new projects worth Rs 8,17,019.34 crore in Q1/FY26), within this sector, the Conventional Electricity sector, consisting of Thermal, Hydel and Nuclear sub-sectors, saw a steep fall of 60.90% in Q1/FY26 on a Q-o-Q basis. In the Solar/wind power sector, nearly 90% of the total fresh investment was by private players. In all, the sector attracted 523 projects worth Rs 7,54,242.18 crore, Rs 4,67,918 crore more than the preceding quarter figure.

Infrastructure: The steep fall of 30.5% in the capex plans of the Government sector, saw fresh investment announcements in this crucial sector coming down by 39.19% in this quarter. As against 3427 new projects worth Rs 6,71,828.04 crore in Q4/FY25, the first quarter of FY2026 saw the announcement of 3321 new proposals worth Rs 4,08,527.63 crore.

But for a couple of mega projects in the Railways, Ports, Airports and Tourism sectors, the fall in fresh investment would have been steeper.

National Capital Region Transport Corpn.'s Regional Rapid Transit System of Rs 15,000 crore spread across Haryana and Uttar Pradesh. A GMR Hyderabad International Airport's Rajiv Gandhi International Airport (Hyderabad) – Expansion at Rs 14000 crore and Gopalpur Ports's Rs 15,000 crore port project at Ganjam, Odisha were some of the prominent infrastructure projects announced in Q1/FY26.

The Data Centre sector, which was receiving increased investment proposals in the recent past, also witnessed a fall in the number of new projects in Q1/FY26.

Another notable development in Q1/FY26 was a sharp decline in investment intentions in the Real Estate sector. The sector experienced a 38.05% decrease in Q1/FY26. Compared to 781 projects valued at Rs 1,29,593 crore announced in Q4/FY25, the survey period saw the announcement of 627 projects worth Rs 80,277 crore.

Manufacturing: The Manufacturing sector managed to register a quarterly growth of 5.72%. As against 441 new projects worth Rs 3,83,782.15 crore announced in Q4/FY25, during the Survey period, 534 new projects worth Rs 4,05,725.59 crore were announced.

But for a couple of super-mega projects in the Metals sector, the sector would have witnessed a sharp decline in fresh investment in Q1/FY26. Those projects are a Rs 1,28,000 crore Aluminium Smelter project of Vedanta in Odisha, a Rs 50,000 crore Green steel project of JSW Steel and a Rs 40,000 crore Stainless steel project of Jindal Stainless both in the state of Maharashtra.

Irrigation: The 308.12% increase seen in the Irrigation sector was mostly because of the Rs 81,900 crore Polavaram-Banakacherla Linking project of Irrigation & CAD Dept., Andhra Pradesh. In all, the sector attracted 108 new projects worth Rs 97,769.89 crore against 105 projects worth Rs 23,956.41 crore in the preceding quarter.

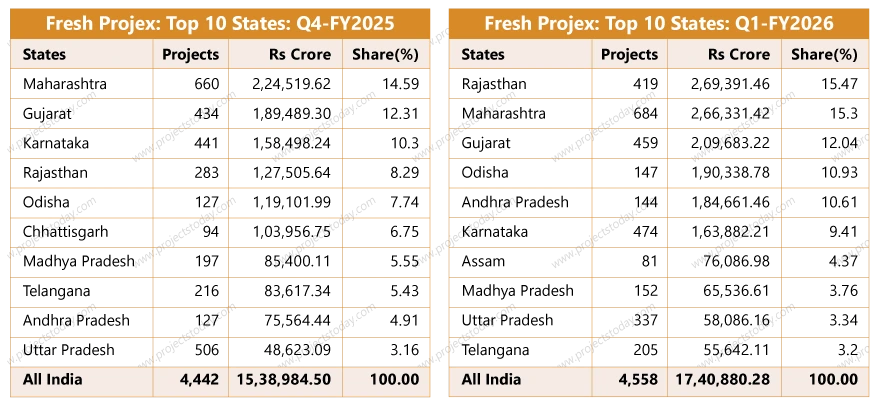

By States

Rajasthan topped the fresh investment table with a total investment of Rs 2,69,391.46 crore in the form of 419 new projects. The dominance of Solar/Wind power projects in this quarter was clearly visible in this state. Around 86.4% of the total fresh investment the state attracted was in the Solar/Wind sector. In all, the state attracted 130 new Solar/Wind projects worth Rs 232646.67 crore.

Maharashtra had to settle for the second place with 684 new projects worth Rs 2,66,331.42 crore. Besides the investment intentions of Rs 90,000 from Jindal group companies and around 40 Solar/Wind projects, the state also benefited from increased investments in the Real Estate, Tourism, and Data Centre sectors.

Following Maharashtra, Gujarat too witnessed a slippage in its rank from 2nd to 3rd in Q1/FY26. In all, the state attracted 459 projects worth 2,09,683.22 crore. After the top-ranked Rajasthan, Gujarat is the next state to benefit the most from the surge in new investment intentions in the Solar/Wind power projects. Around 85% of the total fresh investment the state attracted in Q1/FY26 was found in the Solar/Wind power sector. In all, projects worth Rs 1,78,950 crore investment was seen in this sector.

Odisha ranked 4th up from 6th in the preceding quarter, benefited by a couple of steel projects and a super-mega Aluminium smelter project. In all, the state attracted 147 new projects worth Rs 1,90,338.78 crore in the first quarter of FY2026.

A Rs 1,28,000.00 crore Aluminium smelter Project at Dhenkanal of Vedanta Ltd. alone accounted for 67.2% percent of the total fresh investment the state attracted during the quarter. This was supplemented by a couple of steel projects worth around Rs 15,000 crore.

One super-mega project and scores of Solar/Wind power projects helped Andhra Pradesh to move up from the 9th rank in Q4/FY25 to the 5th rank in Q1/FY26. The state attracted 144 projects worth Rs 1,84,661.46 crore during the Survey period.

A Rs 81,900.00 crore Polavaram-Banakacherla Linking project of the Irrigation & CAD Department, Andhra Pradesh and 25 Solar/Wind power projects together worth Rs 58,964 crore accounted for around three-fourths of the total fresh investment the state attracted in the first quarter of the current fiscal year.

The remaining five states of the top-ten league – Karnataka, Assam, Madhya Pradesh, Uttar Pradesh, and Telangana -- together accounted for one-fourth of the total fresh investment the country received in the first quarter of FY2026.

Outlook-FY2026

During the first quarter of FY26, India’s economic growth trajectory encountered several significant challenges. These included a brief military confrontation with Pakistan, persistent geopolitical tensions, and ongoing uncertainties in international trade tariffs—particularly with one of India’s key trading partners, the United States.

These developments does impacted the announcement of fresh investment intentions by Indian private sector companies especially in the Manufacturing sector. The situation was further exacerbated by a notable decline in public sector capital expenditure, which compounded the overall slowdown in investment momentum.

While an improvement in public capex is anticipated in the coming quarters, external headwinds are likely to continue clouding the investment climate for some time. As a result, private sector players may remain cautious, opting to delay new capacity expansion decisions in favour of focusing on the execution and completion of their ongoing capital expenditure programmes.

In the interim, it is imperative for government agencies to strengthen their project monitoring frameworks. Timely implementation of already-announced Solar and Wind energy projects, as well as key Infrastructure undertakings, is critical to maintaining the pace of economic activity and ensuring that growth prospects are not derailed.