Page 8 - Demo

P. 8

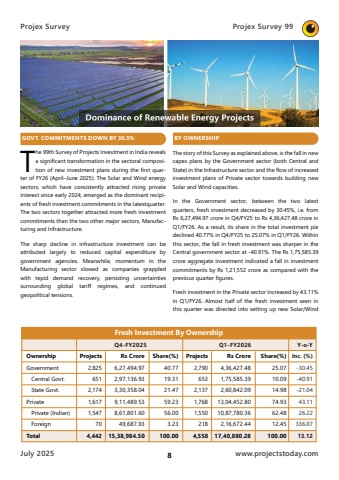

Projex SurveyJuly 20258www.projectstoday.comProjex Survey 99GOVT. COMMITMENTS DOWN BY 30.5%The 99th Survey of Projects Investment in India reveals a significant transformation in the sectoral composition of new investment plans during the first quarter of FY26 (April%u2013June 2025). The Solar and Wind energy sectors, which have consistently attracted rising private interest since early 2024, emerged as the dominant recipients of fresh investment commitments in the latestquarter. The two sectors together attracted more fresh investment commitments than the two other major sectors, Manufacturing and Infrastructure.The sharp decline in infrastructure investment can be attributed largely to reduced capital expenditure by government agencies. Meanwhile, momentum in the Manufacturing sector slowed as companies grappled with tepid demand recovery, persisting uncertainties surrounding global tariff regimes, and continued geopolitical tensions. BY OWNERSHIPThe story of this Survey as explained above, is the fall in new capex plans by the Government sector (both Central and State) in the Infrastructure sector and the flow of increased investment plans of Private sector towards building new Solar and Wind capacities. In the Government sector, between the two latest quarters, fresh investment decreased by 30.45%, i.e. from Rs 6,27,494.97 crore in Q4/FY25 to Rs 4,36,427.48 crore in Q1/FY26. As a result, its share in the total investment pie declined 40.77% in Q4/FY25 to 25.07% in Q1/FY26. Within this sector, the fall in fresh investment was sharper in the Central government sector at -40.91%. The Rs 1,75,585.39 crore aggregate investment indicated a fall in investment commitments by Rs 1,21,552 crore as compared with the previous quarter figures.Fresh investment in the Private sector increased by 43.11% in Q1/FY26. Almost half of the fresh investment seen in this quarter was directed into setting up new Solar/Wind Fresh Investment By OwnershipOwnershipGovernment Central Govt. State Govt.Private Private (Indian) ForeignTotalProjects2,7906532,1371,7681,5502184,558Rs Crore4,36,427.481,75,585.392,60,842.0913,04,452.8010,87,780.362,16,672.4417,40,880.28Share(%)25.0710.0914.9874.9362.4812.45100.00Y-o-Y Inc. (%)-30.45-40.91-21.0443.1126.22336.0713.12Q1-FY2026Projects2,8256512,1741,6171,547704,442Rs Crore6,27,494.972,97,136.933,30,358.049,11,489.538,61,801.6049,687.9315,38,984.50Share(%)40.7719.3121.4759.2356.003.23100.00Q4-FY2025