Page 9 - Demo

P. 9

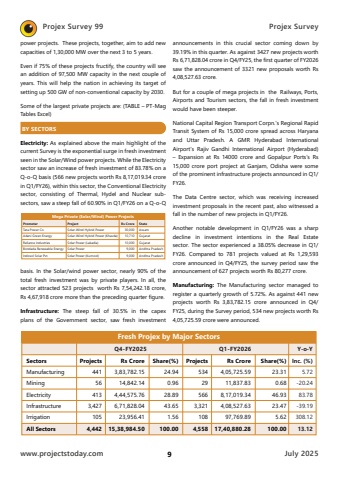

www.projectstoday.comJuly 2025Projex Survey9Projex Survey 99power projects. These projects, together, aim to add new capacities of 1,30,000 MW over the next 3 to 5 years.Even if 75% of these projects fructify, the country will see an addition of 97,500 MW capacity in the next couple of years. This will help the nation in achieving its target of setting up 500 GW of non-conventional capacity by 2030.Some of the largest private projects are: (TABLE %u2013 PT-Mag Tables Excel)BY SECTORSElectricity: As explained above the main highlight of the current Survey is the exponential surge in fresh investment seen in the Solar/Wind power projects. While the Electricity sector saw an increase of fresh investment of 83.78% on a Q-o-Q basis (566 new projects worth Rs 8,17,019.34 crore in Q1/FY26), within this sector, the Conventional Electricity sector, consisting of Thermal, Hydel and Nuclear subsectors, saw a steep fall of 60.90% in Q1/FY26 on a Q-o-Q basis. In the Solar/wind power sector, nearly 90% of the total fresh investment was by private players. In all, the sector attracted 523 projects worth Rs 7,54,242.18 crore, Rs 4,67,918 crore more than the preceding quarter figure.Infrastructure: The steep fall of 30.5% in the capex plans of the Government sector, saw fresh investment announcements in this crucial sector coming down by 39.19% in this quarter. As against 3427 new projects worth Rs 6,71,828.04 crore in Q4/FY25, the first quarter of FY2026 saw the announcement of 3321 new proposals worth Rs 4,08,527.63 crore.But for a couple of mega projects in the Railways, Ports, Airports and Tourism sectors, the fall in fresh investment would have been steeper.National Capital Region Transport Corpn.%u2019s Regional Rapid Transit System of Rs 15,000 crore spread across Haryana and Uttar Pradesh. A GMR Hyderabad International Airport%u2019s Rajiv Gandhi International Airport (Hyderabad) %u2013 Expansion at Rs 14000 crore and Gopalpur Ports%u2019s Rs 15,000 crore port project at Ganjam, Odisha were some of the prominent infrastructure projects announced in Q1/FY26.The Data Centre sector, which was receiving increased investment proposals in the recent past, also witnessed a fall in the number of new projects in Q1/FY26.Another notable development in Q1/FY26 was a sharp decline in investment intentions in the Real Estate sector. The sector experienced a 38.05% decrease in Q1/FY26. Compared to 781 projects valued at Rs 1,29,593 crore announced in Q4/FY25, the survey period saw the announcement of 627 projects worth Rs 80,277 crore.Manufacturing: The Manufacturing sector managed to register a quarterly growth of 5.72%. As against 441 new projects worth Rs 3,83,782.15 crore announced in Q4/FY25, during the Survey period, 534 new projects worth Rs 4,05,725.59 crore were announced. Fresh Projex by Major SectorsSectorsManufacturingMiningElectricityInfrastructureIrrigationAll SectorsProjects534295663,3211084,558Rs Crore4,05,725.5911,837.838,17,019.344,08,527.6397,769.8917,40,880.28Share(%)23.310.6846.9323.475.62100.00Y-o-Y Inc. (%)5.72-20.2483.78-39.19308.1213.12Q1-FY2026Projects441564133,4271054,442Rs Crore3,83,782.1514,842.144,44,575.766,71,828.0423,956.4115,38,984.50Share(%)24.940.9628.8943.651.56100.00Q4-FY2025Mega Private (Solar/Wind) Power ProjectsPromoterTata Power Co. Adani Green Energy Reliance Industries Bondada Renewable Energy Indosol Solar Pvt. ProjectSolar-Wind Hybrid Power Solar-Wind Hybrid Power (Khavda) Solar Power (Lakadia) Solar PowerSolar Power (Kurnool) Rs Crore 30,00010,71010,0009,0009,000StateAssamGujaratGujaratAndhra PradeshAndhra Pradesh