100th Survey of Projects Investment in India

By Mr. Shashikant Hegde, Director, Projects Today

Investment Momentum Sustained Amid Pause in Government Capex

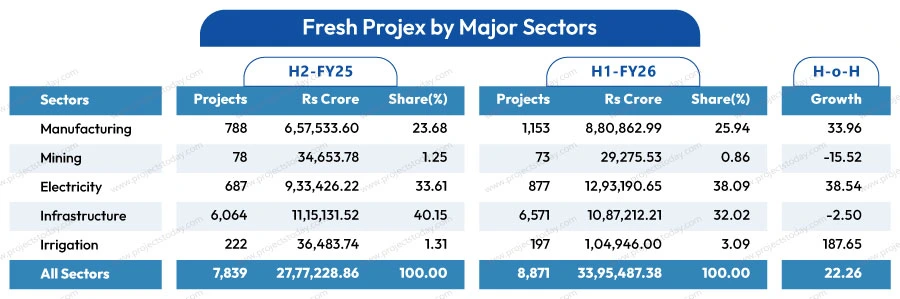

The investment momentum that gathered pace in the latter half of FY2025 extended into the first half of FY2026, though the pace of expansion differed across sectors and ownership groups. During H1-FY25 (April–Sept 2025), the country saw 8,871 new projects worth Rs 33,95,487.38 crore, up 22.26 percent over H2-FY25. The expansion was led by Manufacturing and Electricity, while Infrastructure activity softened following a pause in large government capex proposals.

By Sectors

While overall investment sentiment remained positive in H1-FY26, growth was led primarily by Manufacturing and Electricity, both driven by private-sector proposals and clean-energy initiatives. The Infrastructure sector, which had been the key driver in H2-FY25, showed a temporary pause due to lower government spending. A couple of mega projects saw a healthy increase in the Irrigation sector.

Manufacturing: Expansion Continued

Manufacturing maintained its upward trajectory with Rs 8,80,863 crore of new proposals — up 33.96 percent over the previous half. The sector’s share in the total investment pie increased from 23.68 percent to 25.94 percent, reaffirming its role as a major growth engine. The rise was broad-based, supported by announcements in Steel, Cement, Automobiles, and Electronics, reflecting both private-sector optimism and PLI schemes extended to key industries. Within the sector, momentum came from Metals, Petrochemicals, Fertilisers, Plastics, and Automobiles projects.

In the Metals sector, major capacity buildings by Vedanta’s Aluminium Smelter (Rs 1.28 lakh crore, Dhenkanal), JSW Steel’s Green Steel Plant (Rs 50,000 crore, Salav), and Jindal Stainless’ Raigarh facility (Rs 41,580 crore) pushed total Steel and Aluminium investment to over Rs 3.6 lakh crore.

In the Petrochemicals & Plastics sector, Haldia Petrochemicals’ Rs 90,000 crore Polyethelene project at Mulapeta Port, a Rs 35,000 crore JK Srivastava Hynfra’s Green Hydrogen & Ammonia project at Machilipatnam, and Reliance Industries' Rs 16,600 crore Coal Bed Methane (East & West Sohagpur) dramatically lifted the Basic Chemicals sector.

The automotive revival was symbolised by Hyundai Motor India’s Rs 8,528 crore R&D Centre (Zaheerabad) and Ashok Leyland’s Rs 7,500 crore EV battery unit (Tamil Nadu), boosting this subsector by over 100 percent.

While overall values moderated after an extraordinary H2-FY25 surge, new electronics and chip projects (e.g. Artificial Electronics’ Sapphire Ingots & Wafers, Mihan) helped sustain the manufacturing diversity.

Electricity: Dominated by Renewables

Electricity investments surged further by 38.54 percent, reaching Rs 12,93,190.65 crore and expanding their share from 33.61 percent to 38.09 percent. The continued influx of large-ticket Solar and Wind power projects, coupled with mega-sized Thermal and Hydel power projects, kept this sector at the forefront of the fresh investment landscape. This re-emphasised India’s accelerated transition toward renewable capacity creation. Over the next 2-3 years, around 2,50,000 MW of fresh generation capacity is lined up to be incorporated in the renewable power sector.

Some of the mega Solar projects are by Tata Power Renewables (Bundelkhand, Rs 13,700 crore), Adani Green Energy (Khavda, Rs 10,710 crore), NTPC Renewable Energy (Kutch, Rs 9,975 crore), and Reliance Industries (Lakadia, Rs 10,000 crore). In all, 816 new projects worth Rs 11,11,574.21 crore were announced in the first half of FY2026.

Fresh investment in the Conventional Power sector (comprising Thermal, Hydel and Nuclear) declined by over 40 percent as new coal-based capacities slowed, though NTPC’s Lara Stage-III (Rs 12,176 crore) and THDC’s Khurja Stage-II (Rs 12,365 crore) kept the segment active. While all sub-segments posted declines in the first half, the Hydel power sector attracted 31 new projects. Of this, 15 were of mega size, intending to add around 20,000 MW of generation capacity at a cost of Rs 1,04,190 crore.

Infrastructure: Mild Correction after Strong Growth

After a sharp 72.98 percent jump in H2-FY25, fresh investment in the Infrastructure marginally contracted by 2.50 percent to Rs 10,87,212.21 crore in H1-FY26. The sector’s share in total investment fell notably from 40.15 percent to 32.02 percent. The moderation stemmed largely from a slowdown in government-led capex plans and fewer mega transport and social infrastructure projects.

Major proposals included

- NHAI’s Access-Controlled Expressway (Gorakhpur–Siliguri, Rs 37,465 crore), Greenfield Corridor (Jaipur–Pachpadra, Rs 11,492 crore), and High-Speed Corridor (Lakhnadon–Raipur, Rs 10,000 crore).

- Nagpur Metro Phase III (Rs 8,625 crore) and Delhi–Ambala 3rd & 4th Rail Line (Rs 7,074 crore) led a revival in railway investment, which grew almost four-fold.

- Gopalpur Port expansion (Rs 15,000 crore) and Bengaluru Smart Infrastructure’s Elevated Corridor (Rs 15,000 crore) strengthened the logistics network.

Declines were sharp in Power Distribution and Government Roadway packages, which together reduced the headline growth rate.

Mining: Continued Weakness

Mining remained subdued, registering a 15.5 percent decline to Rs 29,275.53 crore, following a sharper contraction in the previous half. Its contribution to total investment dropped further from 1.25 percent to 0.86 percent, suggesting the absence of large mineral-based project proposals. ONGC was the largest investor in this segment with twin Oil and Gas exploration projects costing Rs 10,267 crore.

Irrigation: Exceptional Jump from a Low Base

The Irrigation sector saw a sharp rebound, with investments rising nearly 188 percent to Rs 1,04,946 crore. Its share in total projects rose from 1.31 percent to 3.09 percent, driven by new state-sponsored irrigation schemes. The surge was anchored by mega state schemes such as Andhra Pradesh’s Polavaram–Banakacherla Linking (Rs 81,900 crore) and Water Resources Department, Maharashtra's Rs 6,394 crore Poshir Dam project.

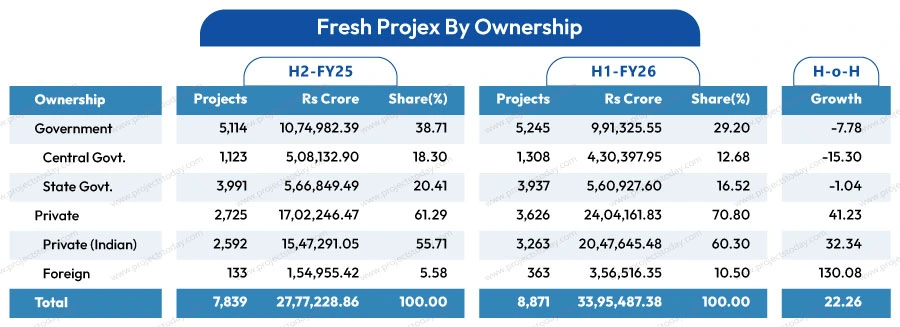

By Ownership: Private sector-led Growth

The investment cycle stayed firm in H1-FY26, but the mix tilted further to the private side. Private promoters lifted outlays by 41.2% to Rs 24.04 lakh crore, taking their share of the total to 70.8% (from 61.3% in H2-FY25). Government proposals, in contrast, eased 7.8% to Rs 9.91 lakh crore, pulling the public share down to 29.2% (from 38.7%).

The lift in the private investment came from a combination of Renewable projects, Metals, Petrochemicals and Data Centres.

In the Renewables & Hydel sectors, mega projects of Tata Power (Solar-Wind hybrid, Rs 30,000 crore); Adani Green (Khavda hybrid, Rs 10,710 crore); Reliance (Lakadia solar, Rs 10,000 crore); Greenko Soygaon Hydel pumped storage (Rs 9,600 crore); and Indosol Solar Kurnool (Rs 9,000 crore) were noteworthy.

Vedanta’s Dhenkanal aluminium smelter (Rs 1,28,000 crore), JSW’s Salav green steel (Rs 50,000 crore) and Jindal Stainless Raigarh (Rs 41,580 crore) kept the domination of the metals sector intact.

Other prominent project proposals were Haldia Petrochemicals’ HDPE at Mulapeta (Rs 90,000 crore) and SRF’s Speciality chemicals (Rs 10,000 crore), Lodha’s Palava Data Centre Park (Rs 30,000 crore), Adaniconnex Navi Mumbai Data centre (Rs 9,786 crore), and Jindal’s renewable-energy equipment plant (Rs 15,000 crore).

Foreign promoters also contributed significantly, proposing projects worth Rs 3.6 lakh crore — a sharp 130 percent increase — led by Yamna’s green ammonia at Krishnapatnam (Rs 20,000 crore); Hinduja Renewables’ pumped-storage in Assam (Rs 14,000 crore); Renew Vikram Shakti’s hybrid at Kurnool (Rs 11,970 crore); NTT’s AI data centre in Hyderabad (Rs 10,500 crore); and Hyundai Motor India’s R&D centre at Zaheerabad (Rs 8,528 crore).

Public-sector proposals slipped down 7.78% to Rs 9,91,325.55 crore, with share sliding to 29.2% in H1-FY26 (38.71 percent in H2-FY25). The decline was value-driven, reflecting fewer mega multi-package road/power-distribution schemes in the half.

Fresh capex from the Central Government slipped by -15.3 percent despite several large Expressway projects by NHAI, which included Gorakhpur–Siliguri access-controlled expressway (Rs 37,465 crore); Guwahati–Silchar (Rs 25,000 crore); Jabalpur–Mandla–Chilpi (Rs 15,000 crore); Lakhnadon–Raipur high-speed (Rs 10,000 crore)—and the NCRTC RRTS (Gurgaon–Faridabad–Greater Noida, Rs 15,000 crore).

The fall in fresh investment was moderate at 1.04 percent in the State Government segment. The total investment by states broadly held ground, supported by Andhra Pradesh’s Polavaram–Banakacherla linking (Rs 81,900 crore), GEC-III intra-state transmission in Gujarat (Rs 28,033 crore), Bengaluru’s twin road tunnels (Rs 8,928 crore & Rs 8,770 crore), Nagpur Metro Phase-III (Rs 8,625 crore), GIPCL Solar, Kachchh (Rs 11,875 crore) and WBPDCL’s Salboni coal power (Rs 10,000 crore). The Water Supply and Power Distribution sectors saw negative growth in fresh investments.

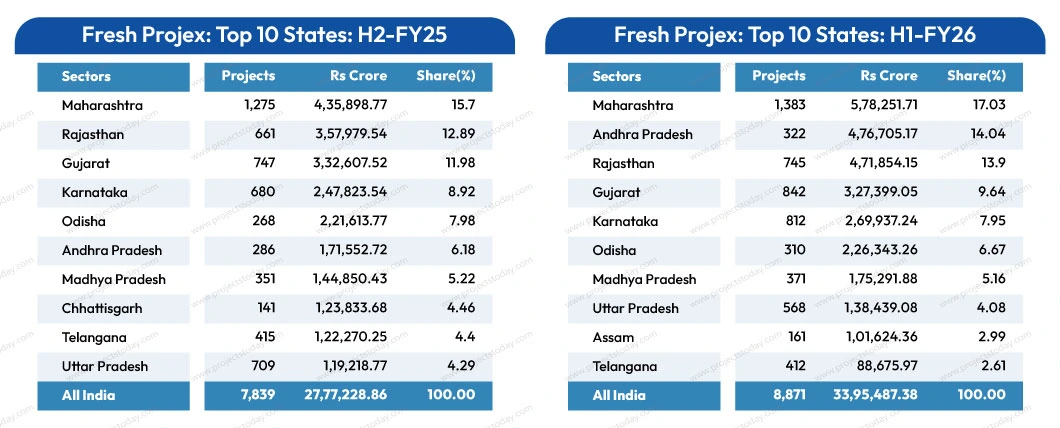

By States

India’s project investment geography in the first half of FY26 remained dynamic, with shifts in state rankings reflecting the timing of mega announcements in Manufacturing, Renewables, and large Infrastructure projects. Total fresh investment across the top ten states rose by over one-fifth (22.3 percent), led by private and energy-centric projects. While most states that featured in the H2-FY25 list retained their positions, Assam newly entered the top ten, replacing Chhattisgarh.

Maharashtra held the leading position with 1,383 projects worth Rs 5,78,251.71 crore, accounting for 17.03 percent of the national total—up 32.7 percent over the previous half. The state’s investment activity spanned across Steel, Petrochemicals, Data Centres, and Real Estate sectors.

Several mega announcements kept its leadership position intact. JSW Steel’s Rs 50,000 crore Green Steel Plant (Salav), Jindal Stainless’ Rs 41,580 crore facility at Raigarh, and Lodha Developers’ Rs 30,000 crore Data Centre Park (Palava). Other high-value industrial and infrastructure plans, such as Reliance Defence’s MRO facility at Nagpur (Rs 20,000 crore) and Adaniconnex’s Data Centre at Navi Mumbai (Rs 9,786 crore) reinforced the state’s diversified investment base.

Andhra Pradesh jumped from sixth to second place, with fresh investment soaring 178 percent to Rs 4,76,705.17 crore (14.04% share). The half-year saw a cluster of mega energy and petrochemical projects—Haldia Petrochemicals’ Rs 90,000 crore HDPE project at Mulapeta, JK Srivastava Hynfra’s Rs 35,000 crore hydrogen and ammonia plant at Machilipatnam, Kalyani Steels’ Rs 30,000 crore steel plant at Mulapeta, Yamna’s Rs 20,000 crore green-ammonia facility at Krishnapatnam, and multiple renewable projects by Renew Vikram Shakti, Chinta Green Energy, and Bondada Renewables. The Rs 81,900 crore Polavaram–Banakacherla linking project added a large irrigation component, rounding out the state’s rise.

Rajasthan slipped to third place as total investment marginally eased (-1.6 percent) to Rs 4,71,854.15 crore, yet the state remained a heavyweight with 13.9 percent of the national share. Key additions came from the Metals and Transport sectors — Hindustan Zinc’s Rs 12,000 crore integrated smelter (Debari) and the NHAI’s Rs 11,492 crore Greenfield Expressway (Jaipur–Pachpadra). The state witnessed the absence of fresh solar megaprojects on the scale of earlier years.

Gujarat ranked fourth, recording Rs 3,27,399 crore, a moderate fall of 1.5 percent on a H-o-H basis. Renewable and Power-transmission projects continued to anchor investment—Adani Green’s Rs 10,710 crore hybrid project (Khavda), Reliance Industries’ Rs 10,000 crore solar at Lakadia, NTPC Renewable Energy’s Rs 9,975 crore Kutch solar park, and the Rs 28,033 crore Green Energy Corridor-III by Gujarat Energy Transmission Corporation collectively gave the state a strong clean-energy profile.

Karnataka maintained fifth rank with a total investment of Rs 2,69,937.24 crore, showing 8.92 percent growth. The focus remained on urban connectivity and township development. BMRDA’s Rs 20,000 crore Township (Bidadi), Bengaluru Smart Infrastructure’s Rs 15,000 crore elevated corridor, and the twin BBMP tunnels (Rs 8,928 crore and Rs 8,770 crore).

Odisha’s investment flow remained stable at Rs 2,26,343.26 crore (up 2.13 percent). The state continued to benefit from its strong base in Metals and Port infrastructure, led by Vedanta’s Rs 1,28,000 crore aluminium smelter (Dhenkanal), Gopalpur Port’s Rs 15,000 crore expansion, SRF’s Rs 10,000 crore speciality-chemicals unit (Ganjam), and National Aluminium’s Rs 12,000 crore coal-based power project (Angul). Together, these projects sustained Odisha’s sixth-place standing.

Madhya Pradesh climbed slightly to seventh position, posting Rs 1,75,291.88 crore, a 21 percent rise. Major new proposals included Reliance Industries’ Rs 16,600 crore CBM expansion (East & West Sohagpur) and the NHAI’s Rs 15,000 crore Jabalpur–Mandla–Chilpi road upgrade, supplemented by ongoing coal and cement-based projects.

Uttar Pradesh’s project value rose 16.12 percent to Rs 1,38,439 crore, lifting it to eighth place. The half-year featured several high-value central government and private investments: THDC India’s Rs 12,365 crore Khurja thermal plant, Tata Power Renewable Energy’s Rs 13,700 crore ultra-supercritical unit (Bundelkhand), and NHAI’s Rs 9,200 crore Ayodhya–Varanasi express corridor.

Assam entered the top ten with an impressive 382.23 percent jump to Rs 1,01,624.36 crore, driven by a couple of mega projects. Among them were Tata Power’s Rs 30,000 crore Solar-Wind Hybrid, Hinduja Renewables’ Rs 14,000 crore pumped-storage hydel project, JK Lakshmi Cement’s Rs 11,000 crore integrated plant, and NHAI’s Rs 25,000 crore Guwahati–Silchar Expressway. The high-ticket Renewable and Roadways projects helped the state replace Chhattisgarh in the national top ten.

Telangana slipped to tenth place with Rs 88,675.97 crore, 27.48 percent below the previous half. Yet it attracted major private investments such as GMR Hyderabad Airport’s Rs 14,000 crore expansion, NTT Global Data Centres’ Rs 10,500 crore AI facility, and Hyundai Motor India’s Rs 8,528 crore R&D centre at Zaheerabad.

FY2026 Investment Outlook

The investment climate in India through FY2026 is poised to sustain its upward trajectory, building on the firm base laid during the first half of the fiscal. Despite global uncertainties, the domestic fundamentals remain robust. The H1-FY26 (April–Sept 2025) demonstrated resilience with a 22 percent rise in fresh investment announcements, led by private-sector proposals in the Manufacturing and Renewable energy sectors. The second half is expected to reinforce this trend, supported by a rebound in public infrastructure spending and steady consumer demand. Private investment is likely to retain its lead in FY2026. Having accounted for over 70 percent of total new investment proposals in H1-FY26, private promoters showed strong intent in long-gestation and high-value projects across renewable energy, metals, petrochemicals, and digital infrastructure.

While government-led projects moderated slightly in H1-FY26, the trend is expected to reverse in the latter half of the year. Thus, the Central and State sectors together are likely to close the year with a healthy year-on-year expansion.

The global landscape remains complex, with geopolitical tensions, commodity-price swings, and tariff uncertainties influencing investment decisions. However, India continues to offer a relatively safe haven, with policy stability, a growing domestic market, and an improved business environment. The Reserve Bank’s calibrated monetary stance, coupled with moderating inflation, further supports capital formation.

While export-oriented sectors may feel the pinch of global trade frictions, sectors like Construction, Electronics, Automobiles, Data Centres, Transport and Social infrastructure are expected to keep the aggregate investment outlook buoyant.