101st Survey of Projects Investment in India

By Mr. Shashikant Hegde, Director, Projects Today

Slowdown in Private Investment in Q3/FY26

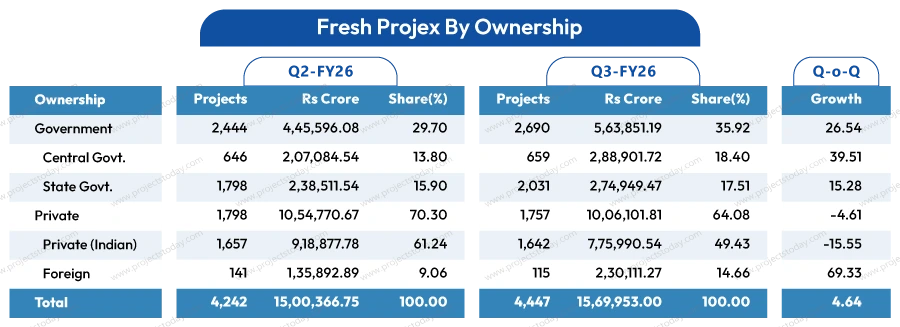

After a sharp contraction in the previous quarter, fresh investment announcements showed a modest recovery in Q3/FY26. According to the 101st Survey of Projects Investment in India, the total fresh investment increased by 4.64 percent over Q2/FY26 to Rs 15,69,953.00 crore, reversing the -20.83 percent decline recorded in Q2/FY26 over Q1/FY26. The number of projects also rose, up 4.83 percent to 4,447, indicating a slightly broader spread of new proposals even as investment intentions remained uneven across sectors and ownership categories.

This improvement, however, was not broad-based. The uptick in Q3/FY26 was shaped mainly by a revival in public sector capital spending and a limited set of large foreign-funded projects. In contrast, domestic private investment remained subdued, with several private capex-led sectors showing weakness. As a result, the quarter reflects a recovery in headline numbers, but with the investment cycle still dependent on government-led activity and select large projects rather than a consistent improvement in private sector capacity expansion.

By Ownership

In Q3/FY26, the Public sector led the rebound. Government investment rose 26.54 percent Q-o-Q to Rs 5,63,851.19 crore, with projects up 10.07 percent (from 2,444 to 2,690). Consequently, the Government share increased to 35.92 percent from 29.70 percent (a gain of +6.22 percentage points), mirroring the Private share decline to 64.08 percent from 70.30 percent (-6.22 points). In absolute terms, Government added Rs 1,18,255.11 crore Q-o-Q, which more than compensated for the Rs 48,668.86 crore decline in the overall Private segment.

Central Government Investment intentions jumped 39.51 percent to Rs 2,88,901.72 crore, even though the number of new projects remained almost static (646 in Q2/FY26 to 659 in Q3/FY26). This indicates larger ticket-size announcements, with average project size rising materially (from ~Rs 321 crore/project to ~Rs 438 crore/project).

New project announcements by the State Government agencies grew at a healthy 12.96 percent (1,798 to 2,031) and investment therein rose 15.28 percent to Rs 2,74,949.47 crore.

Fresh investment intentions in the private sector declined for the second consecutive quarter, but the pace of decline moderated. On Q-o-Q basis, the fresh investment fell 4.61 percent to Rs 10,06,101.81 crore, and count of new projects declined 2.28 percent (from 1,798 in Q2/FY26 to 1,757 in Q3/FY26). Within the Private sector, fresh investment commitments by the Private (Indian) companies dropped 15.55 percent to Rs 7,75,990.54 crore, while number of projects remained almost unchanged (-0.91 percent). This explains the fall in the number of mega projects, as fewer large domestic private proposals were recorded. The share of Private (Indian) fell sharply to 49.43 percent from 61.24 percent (-11.81 points).

A couple of super mega projects saw the aggregate fresh investment by the Foreign entities increase by 69.33 percent to Rs 2,30,111.27 crore. This was despite the decline in the number of new projects from 141 in Q2/FY26 to 115 in Q3/FY26. The Foreign share increased to 14.66 percent from 9.06 percent (+5.60 pp), partially cushioning the broader private slowdown, but also indicating higher dependence on a small set of super/mega projects. A Rs 98,000 crore artificial intelligence Data Centre of Digital Connexion at Visakhapatnam, Andhra Pradesh and a Rs 24,000 crore Closed Loop Pumped Storage Project of Greenko Energies in Telangana were the two super mega projects announced in Private (Foreign) sector.

By Sectors

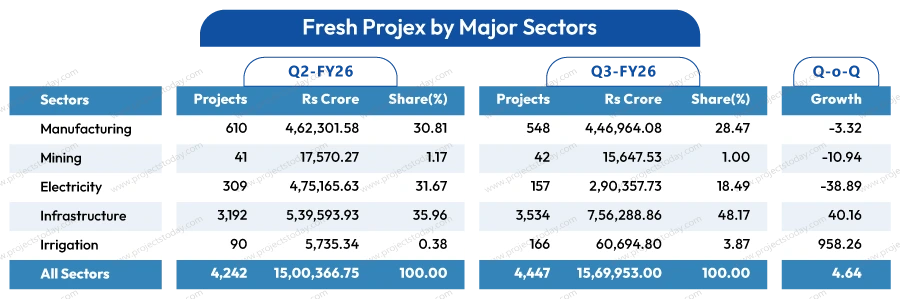

This headline gain in fresh investment in Q3/FY26 was largely shaped by a sharp sectoral divergence. Of the five major sectors, while the Infrastructure and Irrigation sectors expanded strongly, the Manufacturing and Electricity sectors fared badly.

Manufacturing: Mild Decline

Manufacturing, which mirrors private sector investment appetite, recorded a 3.32 percent decline in announced value (from Rs 4,62,301.58 crore to Rs 4,46,964.08 crore) and a 10.16 percent fall in the number of new projects (from 610 to 548). Consequently, its share in total fresh investment slipped from 30.81 percent in Q2/FY26 to 28.47 percent in Q3/FY26. Within the Manufacturing sector, investment intentions improved in select sub-sectors such as Pharma, Electronics and Defence-related manufacturing, while several large, traditionally investment-heavy industries like Steel, Cement and Automobiles saw lower announcements, pulling down the sector’s aggregate fresh investment.

Some of the large projects announced in this sector were a Rs 84,000 crore Coal Gasification Chemicals (Sundargarh) project of Adani Enterprises in Odisha, a Rs 17,066 crore Carbon Black (Paddhar) project of Balkrishna Industries in Gujarat, a Rs 12,800 crore Drones (Mihan-SEZ) project of Solar Defence & Aerospace in Maharashtra, and a Rs 12,422 crore Green Methanol project of Acme Akshay Energy in Odisha.

Electricity: Sharp Fall in Renewables

Electricity witnessed the steepest quarterly deterioration among major sectors, with fresh investment value falling by 38.89 percent Q-o-Q and fresh project count declining by 49.19 percent. As a result, the sector’s share in total investment dropped sharply from 31.67 percent to 18.49 percent, making it the single largest drag on the overall trend witnessed in Q3/FY26. The decline was driven mainly by a sharp slowdown in non-conventional power, where announced investment fell materially (notably in Solar and Wind). In contrast, conventional power showed improvement, with higher announcements in the Hydel and Thermal segments. But these improvements were insufficient to compensate for the pullback seen in the renewables segment.

Some of the large conventional power projects announced during the third quarter were a Rs 24,000 crore Ippagudem Closed Loop Pumped Storage project of Greenko Energies in Telangana, a Rs 19,950 crore Pumped Storage Hydel Power project of JSW Neo Energy in Maharashtra, a Rs 48,000 crore Ultra Supercritical Thermal Power project of Adani Power in Assam, and a Rs 22,900 crore thermal power plant of Torrent Power in Chhattisgarh.

Infrastructure: Strong Rebound

Infrastructure provided the principal cushion to the overall investment momentum. Announced investment in infrastructure rose by 40.16 percent Q-o-Q to Rs 7,56,288.86 crore, and the number of projects increased by 10.71 percent to 3,534. Its share in total fresh investment expanded significantly from 35.96 percent to 48.17 percent. The upturn was supported by stronger activity in segments such as Transport services (including sizeable gains in Railways and Ports), Power Distribution, and Urban/community infrastructure categories, even as some components like Roadways and Real Estate reported weaker announcements.

Fresh investment announcements in Transport and Power Distribution infrastructure strengthened further in Q3/FY26, even as the road segment showed a mild moderation. Nevertheless, the Roadways remained one of the largest sub-sectors in absolute terms, with fresh investment of Rs 1,45,280.60 crore in Oct–Dec 2025, despite a -11.12 percent Q-o-Q decline from Rs 1,63,454.50 crore in Jul–Sep 2025 period. Interestingly, this came alongside a rise in activity, with project count increasing from 809 to 859 (+6.18 percent), indicating sustained breadth of announcements even as value eased from a high base. In contrast, Railways recorded a sharp rise in investment value to Rs 83,813.74 crore, up 219.90 percent Q-o-Q, even though the number of projects fell from 83 to 54 (-34.94 percent), suggesting that fewer, larger-ticket proposals dominated the quarter.

The most striking improvement was seen in the Shipping Infrastructure, where the fresh investment surged to Rs 1,05,296.37 crore in Q3/FY26 from Rs 11,110.43 crore in the previous quarter, a jump of 847.73 percent Q-o-Q, supported by higher project activity as well (29 to 54 projects; +86.21 percent). A significant portion of this expansion was anchored by two mega projects totalling Rs 57,000 crore by Deendayal Port Authority in Gujarat.

Alongside this, Power Distribution also saw a strong step-up, with announced investment rising to Rs 73,005.26 crore from Rs 8,245.01 crore (+785.45 percent Q-o-Q) and project count increasing from 132 to 218 (+65.15 percent). This heightened focus on distribution infrastructure is expected to ease grid constraints and improve evacuation readiness, which in turn should support a revival in solar power project announcements in the coming quarters.

Construction sector, comprising Commercial Complexes, Real Estate, Data Centres and Industrial Parks recorded a modest growth of 3.84 percent in Q3/FY26 on Q-o-Q basis. Among the sub-sectors the more important Real Estate and Industrial Parks sectors recorded a steep fall of 41.30 percent and 70.63 percent respectively. On the other hand, Commercial Complexes (+84.18 percent) and Data Centres (+181.26 percent) stemmed the overall downfall in this sector.

Irrigation: Spike from a Low Base

A notable change was seen in Irrigation, where investment announcements surged from a low base. The sector recorded a 958.26 percent jump in announced value (to Rs 60,694.80 crore) and an 84.44 percent rise in project count, lifting its share from 0.38 percent to 3.87 percent. While this spike reflects a sharp quarter-specific increase and a base effect, it still meaningfully contributed to keeping total investment growth positive.

Mining: Marginal and Softer

Mining remained marginal in the overall mix and softened in value terms. While the number of projects in mining rose slightly (+2.44 percent), investment value declined by 10.94 percent, and its share edged down from 1.17 percent to 1.00 percent.

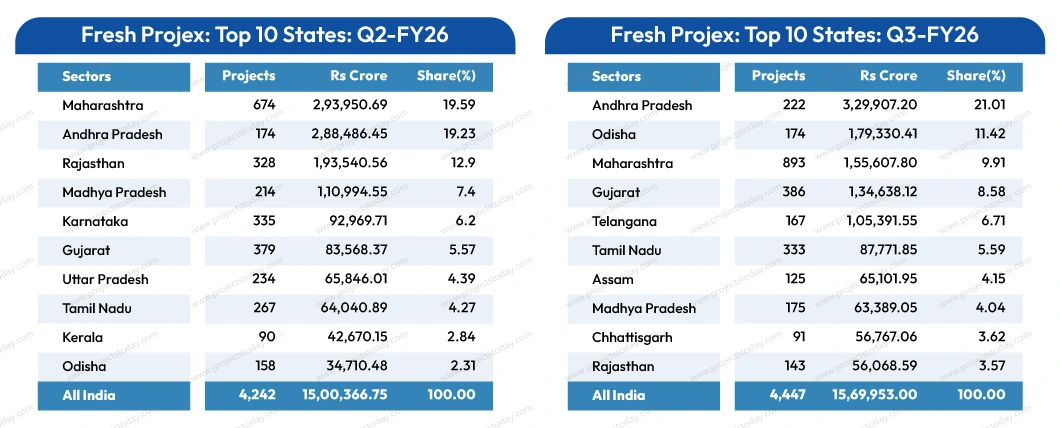

By States

Fresh investment announcements in Q3/FY26 (Oct–Dec 2025) were heavily concentrated in a few large states, with the Top 10 accounting for the bulk of the new investment. Andhra Pradesh led decisively with Rs 3,29,907.20 crore, contributing 21.01 percent of all-India fresh investment, followed by Odisha with Rs 1,79,330.41 crore (11.42 percent). Together these two states accounted for one-third of the fresh investment announced in the third quarter of the fiscal FY2026.

The third ranked Maharashtra attracted investment of Rs 1,55,607.80 crore (9.91 percent) but stood first in project count (893), indicating a larger number of relatively smaller and mid-sized announcements. Gujarat followed with Rs 1,34,638.12 crore (8.58 percent) largely helped by the Rs 57,000 crore investment commitment of Deendayal Port Authority. The fifth ranked Telangana (Rs 1,05,391.55 crore; 6.71 percent) benefitted from the Rs 24,000 crore Pumped Storage Hydel Power project of Greenko Energies.

Tamil Nadu (Rs 87,771.85 crore; 5.59 percent) reinforced the investment pull of industrial and infrastructure linked proposals. The lower half of the Top 10, Assam, Madhya Pradesh, Chhattisgarh, and Rajasthan, each contributed about 3.6–4.2 percent of total investment, but their rankings were meaningfully influenced by a small number of large-ticket proposals.

Private Investment in States

Private investment announcements in Q3/FY26 (Oct–Dec 2025) were led by Andhra Pradesh, which attracted Rs 2,54,117.78 crore, accounting for 25.26 percent of all private sector investment announced in the quarter. Further, the private proposals constituted roughly three-fourths of Andhra Pradesh’s total fresh investment for the quarter.

Odisha ranked second with Rs 1,34,698.25 crore, contributing 13.39 percent of India’s private investment announcements. Maharashtra, despite having the highest number of private projects (571), stood third in private investment value at Rs 1,08,111.14 crore, representing 10.75 percent of the all-India private total. The state received more mid-sized proposals rather than a few high-ticket announcements.

Telangana secured Rs 78,439.48 crore (7.80 percent share), followed by Tamil Nadu with Rs 68,511.32 crore (6.81 percent share), reinforcing their continued ability to attract private industrial and services-linked proposals. Assam is noteworthy for the intensity of private dominance. Of the total investment attracted by the state in Q3/FY26, private investment was close to 93 percent (Rs 60,399.84 crore). Chhattisgarh reported Rs 54,999.33 crore (5.47 percent), while Gujarat recorded Rs 53,710.77 crore (5.34 percent). Gujarat, traditionally one of the favourite investment destinations of private promoters, attracted relatively lower private investment in the quarter.

Rounding out the private top ten, Madhya Pradesh posted Rs 48,502.93 crore (4.82 percent), and Karnataka recorded Rs 35,560.27 crore (3.53 percent). The latter’s presence in the private top ten—despite not featuring in the overall top ten—suggests that while Karnataka drew meaningful private announcements, the absence of large proposals limited its overall standing in total fresh investment during the quarter.

Outlook for Q4 of FY26

The rebound in infrastructure investment announcements in Q3/FY26 is an encouraging signal and should continue to provide near-term support to overall investment momentum. However, sustaining the current economic growth requires a steadier pipeline of capacity creation in manufacturing, which depends largely on an improved flow of private investment.

While domestic macro conditions remain supportive, often described as a Goldilocks phase with stable demand and manageable inflation, the willingness of private promoters to commit to large new capex may remain cautious in the near term. Global headwinds, including renewed tariff-related risks, geopolitical uncertainty and a softening export environment, are likely to keep risk appetite restrained and delay final investment decisions in private-led sectors.

Against this backdrop, Q4/FY26 is expected to lean more on the public sector to hold up the investment cycle. With private capex likely to remain selective, government-led spending in transport, logistics, urban infrastructure and power distribution should continue to anchor overall activity.

Expectations are also building around the Union Budget 2026–27 (to be presented in February 2026). Any meaningful increase in infrastructure outlays for FY2027 would strengthen the visibility of project awards and front-end announcements, and could help crowd in private investment over subsequent quarters.

Overall, the near-term outlook points to continued infrastructure-led support, while a broader-based revival will depend on whether private manufacturing investment regains confidence as global uncertainties ease.