Tender Nos. Drop Sharply, Values Hold Up in Q1–Q3/FY26

By Team Projects Today

Project tendering activities saw a sharp down fall in the number of tenders and a small increase in tender value in the first three quarters of FY26 (Q1-Q3/FY26). As against 1,01,983 project tenders worth Rs 11,63,386.47 crore announced in Q1-Q3/FY25, the country saw the announcement of 74,762 tenders worth Rs 11,90,196.33 crore in Q1-Q3/FY26.

Increase in the number of mega-value tenders (Rs 1,000 crore and above) helped in holding up the aggregate tender values by 2.30 percent, while the number of tenders declined by a steep 26.69 percent during the first three quarters of FY2026. As many as 117 mega-value tenders with an aggregate value of Rs 2,93,296.17 crore were issued in Q1-Q3/FY26. These mega tenders accounted for 24.64 percent of the total value of project tenders issued during the Survey period. During the same period of the last fiscal year, the country had seen the issuance of 129 mega tenders worth Rs 2,48,366 crore.

The most notable tender of Q1-Q3/FY26 worth Rs 19,238.57 crore was issued by the Vadhavan Port Project for the development & maintenance of land to be created offshore of Vadhvan Coast by dredging, reclamation and construction of an offshore protection bund for Vadhvan Port in Raigarh district of Maharashtra to be executed on Hybrid Annuity Mode.

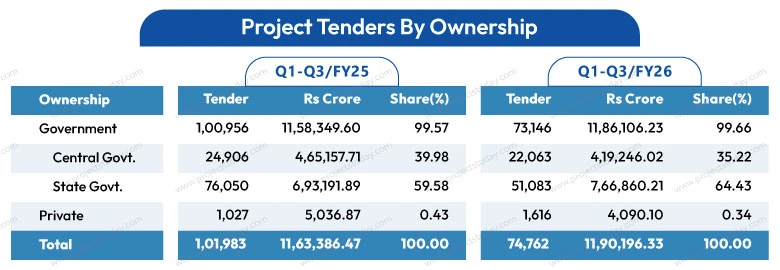

By Ownership

The dominance of the government sector in project tendering was imminent, with the sector accounting for 99.66 percent of the total value of the tenders issued. The tendering by the State government agencies saw decreases in numbers but an increase in value in the first three quarters. In all, 51,083 project tenders with a contract value of Rs 7,66,860.21 crore were issued by the State government agencies during Q1-Q3/FY26 as compared with 76,050 tenders worth Rs 6,93,191.89 crore in Q1-Q3/FY25.

In the case of Central government agencies, the decline was seen both in terms of the number of tenders issued as well as the aggregate tender value. In all, 22,063 project tenders with a contract value of Rs 4,19,246.02 crore were issued by the Central government agencies during Q1-Q3/FY26 as compared with 24,906 tenders worth Rs 4,65,157.71 crore in Q1-Q3/FY25.

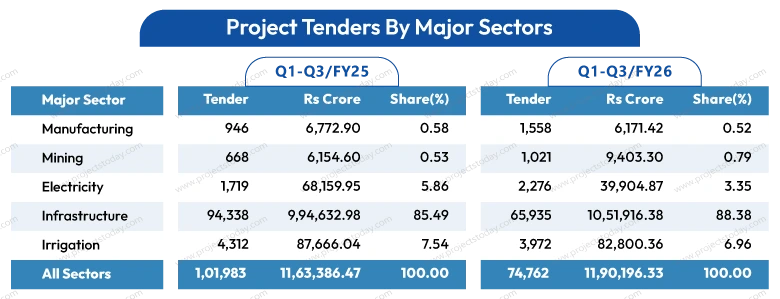

By Sectors

The Infrastructure and Irrigation sectors remained frontrunners in tendering activities in the first nine months of FY26 and accounted for 95.34 percent of the total tender values floated.

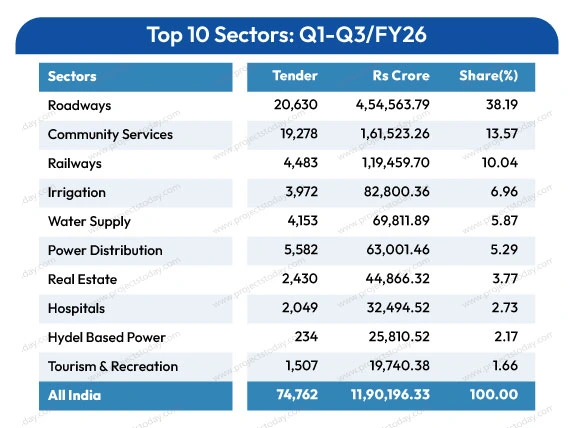

The Infrastructure sector saw the publishing of 65,935 project tenders worth Rs 10,51,916.38 crore in the first three quarters of this fiscal as against 94,338 tenders worth Rs 9,94,632.98 crore in the same period a year ago. Among the major sub-sectors, Roadways, Community Services and Railways remained highly active in tendering activities. Together, these three sectors accounted for 61.80 percent of the total tender value issued in Q1-Q3/FY26.

The Roadways remained as the dominant sector both in terms of numbers and value. Despite 31 percent fewer tenders, the aggregate value of the tenders issued increased by 22 percent, pushing its share up to 38.19 percent. This indicates the presence of high-value tenders during the Survey period. Total tendering activity in this sector grew from 29,774 tenders worth Rs 3,71,854.47 crore in Q1-Q3/FY25 to 20,630 tenders worth Rs 4,54,563.79 crore in Q1-Q3/FY26.

The largest tender floated in this sector was by the Bengaluru Smart Infrastructure for design & construction of 3-lane underground twin tunnel road from Hebbal Esteem Mall Junction (km. 0.000) to Silk Board KSRP Junction (km.16.745) along with 3 lane or 2 lane entry & exit ramps including operation and maintenance in Bengaluru City North South Corridor on modified BOOT mode under Package-1&2 in Karnataka. The aggregate value of the tenders was Rs 17,698 crore.

Another notable tender worth Rs 8,534.63 crore was issued by NHAI for the development of a 6-lane access-controlled regional expressway on the northern side of Hyderabad from Girmapur village (ch.1.518) in Sangareddy to Tangad Palle village (ch.160.000) with a length of 161.518 km in Telangana under NH (O) on HAM mode (Package I to V).

Three nodal agencies, the National Highways Authority of India, Government of India, Ministry of Road Transport & Highways (MoRTH) and Bihar State Road Devp. Corpn. were the prominent tender issuers in terms of cost.

Of the 117 mega-value tenders issued during Q1-Q3/FY26, NHAI alone floated 31 tenders for various road works worth Rs 69,790.73 crore. MoRTH floated 675 tenders for various works worth Rs 51,529.59 crore during the first three quarters of FY2026. Bihar State Road Devp. Corpn. floated 36 tenders for various works worth Rs 24,079.92 crore during the first three quarters of FY26.

The Community Services sector saw a contraction in tenders (-38 percent) but a rise in tender value (+6.6 percent) during the first three quarters of FY2026. The sector saw the issuance of 19,278 tenders worth Rs 1,61,523.26 crore during Q1-Q3/FY26 against 31,176 tenders worth Rs 1,51,549.24 crore in the first three quarters of the previous fiscal.

The largest tender in this sector was floated by the PWD, Maharashtra, for the construction of the new integrated high court complex on plot bearing C.T.S. No 629/1234/A/1 at Bandra Government Colony in Mumbai on EPC Mode I, worth Rs 4,127.47 crore.

Railways saw declines in both tenders (-27.26 percent) and value (-2.13 percent). During the first three quarters 4,483 tenders worth Rs 1,19,459.70 crore were issued against 6,163 tenders worth Rs 1,22,055.77 crore in Q1-Q3/FY26. The most notable tender in this sector was floated by the Andhra Pradesh Metro Rail Corpn. for the engineering, design and construction of viaduct length 46.23 km (3 corridors) (including 20.16 km of double-decker 4-lane flyover cum metro viaduct) and 42 nos. elevated metro stations, etc., all as specified on EPC basis for Phase 1 of Visakhapatnam Metro Rail at Visakhapatnam in Andhra Pradesh. The aggregate value of these tenders was Rs 6,250 crore.

In the Irrigation, modest declines were seen in tenders (-7.88 percent) and value (-5.55 percent) during Q1-Q3/FY26. The Irrigation sector saw 3,972 tenders valued at Rs 82,800.36 crore in Q1-Q3/FY26 as against 4,312 tenders worth Rs 87,666.04 crore floated in Q1-Q3/FY25.

The most notable tender in this sector was floated by the Eastern Rajasthan Canal Project Corpn. for the construction of Mor Sagar artificial reservoir & feeder from Bisalpur to Mor Sagar artificial reservoir, including all components with its O & M for a period of 20 years on Hybrid Annuity Model in Rajasthan. The aggregate value of this tenders was Rs 4,138.39 crore.

Further, eleven of the total 117 mega-value tenders issued during Q1-Q3/FY26 were in the Irrigation sector. These tenders are valued at Rs 27,433.88 crore.

In the Power Distribution sector, while the number of tenders dipped by -6.14 percent, the fall in total value was much sharper at -39.67 percent. As against 5,947 tenders worth Rs 1,04,424.85 crore were issued during the first three quarters of FY2025, 5,582 tenders worth Rs 63,001.46 crore were issued in the first nine months of FY26.

A notable tender in this sector was issued by the M P Paschim Kshetra Vidyut Vitran Co. with an aggregate value of Rs 1,065.54 crore for the AMC & support of advanced metering infrastructure (AMI) for a period of 3 years in Indore City of Madhya Pradesh.

Despite an increase in the number of fresh tenders in the Real Estate sector, the aggregate value decreased by 3.39 percent. As against 2,345 project tenders worth Rs 46,440.88 crore issued in the three quarters of FY2025, 2,430 project tenders worth Rs 44,866.32 crore were issued in Q1-Q3/FY26.

Maharashtra Housing & Area Devp. Authority (MHADA) floated a tender for the redevelopment of Kamathipura Cluster Lane 1 to 15 in Mumbai. The aggregate value of the tenders was Rs 7,083 crore.

In the Mining sector during the first nine months of this fiscal, 1,021 mining tenders worth Rs 9,403.30 crore were issued. This included three mega tenders together valued at Rs 4,200.23 crore. The public sector company, Singareni Collieries Co. issued a noteworthy tender for the selection of MDO for the operation of Naini Coal Mine in Odisha, worth Rs 1,604.42 crore.

The Electricity sector saw issuance of 2,276 tenders worth Rs 39,904.87 crore in Q1-Q3/FY26 as against 1,719 tenders worth Rs 68,159.95 crore in Q1-Q3/FY25. Despite the increase in the number of tenders and the presence of seven high-ticket tenders worth Rs 29,023.65 crore, the aggregate value declined by 41.45 percent.

The largest value tender was issued by the NHPC for the Lot-3, Main dam, including coffer dam and HM works of the Dibang multipurpose project in Arunachal Pradesh, worth Rs 17,069.79 crore.

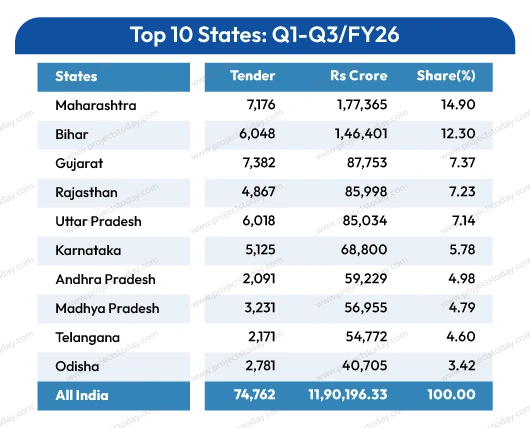

By States

Project tendering activity across the Top 10 states weakened significantly in Q1–Q3/FY26 compared with Q1–Q3/FY25. The combined number of tenders in the top 10 fell from 68,446 to 46,890 (-31.49 percent). Even so, the aggregate tender value for these states inched up from ₹8,46,028 crore to ₹8,63,012 crore (+2.01 percent). Consequently, the top 10 states continued to account for almost the same share of all-India tender value 72.72 percent in FY25 versus 72.51 percent in FY26, indicating that fewer tenders were offset by larger-ticket tenders.

In Q1–Q3/FY26, Maharashtra retained the top position by tender value, although its performance softened. Tender numbers in the state almost halved from 14,335 to 7,176 and tender value declined by 11.80 percent to ₹1,77,364.68 crore, pulling its share down from 17.29 percent to 14.90 percent. Bihar, ranked second, recorded the most dramatic improvement in value. Despite a 20.84 percent fall in tender numbers (7,640 to 6,048), tender value surged by 121.27 percent to ₹1,46,400.96 crore, lifting its share sharply from 5.69 percent to 12.30 percent.

Gujarat, the third-ranked state, saw tender numbers decline from 10,008 to 7,382 (-26.24 percent), but tender value increased by 12.13 percent to ₹87,752.83 crore, keeping its share broadly stable at around 7.37 percent. Rajasthan followed with a steep contraction. Both tender numbers and value declined by 28.89 percent and 31.37 percent respectively. In all, the state saw floating of 4867 tenders worth Rs 85,997.80 crore.

Among the remaining states, Uttar Pradesh registered fewer tenders (7,943 to 6,018; -24.24 percent) but a small rise in tender value (+3.94 percent) to ₹85,034.44 crore, resulting in a marginal share gain to 7.14 percent. Karnataka recorded declines in both tenders (6,319 to 5,125; -18.90 percent) and value (-20.30 percent) to ₹68,799.74 crore, reducing its share to 5.78 percent. Andhra Pradesh emerged as a new entrant to the FY26 Top-10 list with tenders worth ₹59,229.23 crore (4.98 percent share).

Madhya Pradesh also declined on both counts — tenders down 17.05 percent and value down 19.47 percent to ₹56,955.04 crore — lowering its share to 4.79 percent. Telangana saw tender numbers dip 9.73 percent (2,405 to 2,171) but value rise 9.81 percent to ₹54,772.20 crore, nudging up its share to 4.60 percent. Odisha was another new entrant, contributing ₹40,705.05 crore (3.42 percent share). Reflecting this churn, Tamil Nadu and Jharkhand, which featured in FY25’s Top-10, dropped out of the FY26 top tier.